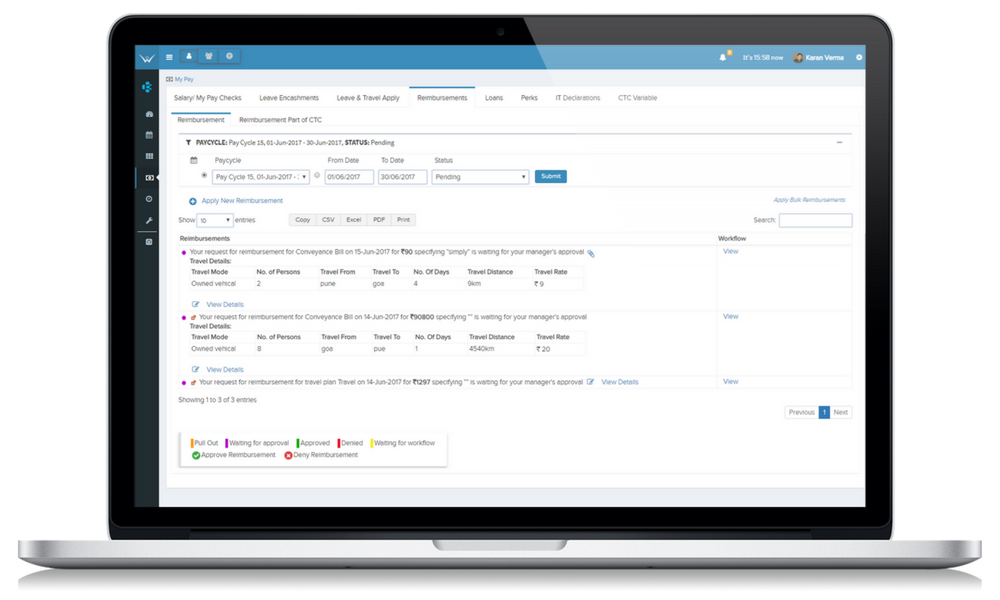

Create your Travel plan, Apply for travel, just the way you apply for Leaves. On similar lines Workrig`s travel leave management system allows the HR to apply for Travel on an Employee’s behalf. One can apply for travel advance and accounts’ pays for the same.

Be it travel or exception handling, Workrig’s employee & manager self-service uses technology to permit employees to perform tasks intuitively that previously were handled by a company’s human resources or administrative staffs. Let employees produce their explanations when an exception is created or leave is required.